Contents:

A stop loss is set above the previous local high or below the previous local low (depending on the trade price movements’ direction). There are several profitable strategies to trade with the Momentum indicator. The choice of the trading platform or a trading instrument will not affect the Momentum trading performance.

Overbought and oversold zone ranges are determined separately for each trading instrument. This popular momentum indicator measures the momentum, the velocity, and magnitude of price movements. The stronger is the relative price movement up, the greater is the indicator reading. The stronger is the relative price movement down, the closer the oscillator line to 0. Studying the above examples, we can conclude that the interpretation of signal lines is a complex approach. You should understand the current market sentiment and refer not only to indicator signals but also take into account the rules of your trading strategy.

Profitability of momentum strategies in the international equity markets

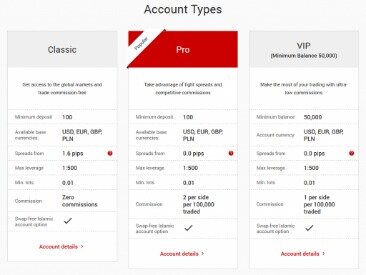

78% of retail investor accounts lose money when spread betting and/or trading CFDs with this provider. You should consider whether you understand how spread bets and CFDs work and whether you can afford to take the high risk of losing your money. It is not relevant to compare the Bollinger Bands, the Momentum indicator, the Fibonacci, or the Blade Runner strategies because they all have different trading objectives. The listed trading strategies are unique in their own way and are powerful tools in the hands of experienced traders who practise trading them to manage their personal finance and virtual funds.

How do you create a momentum trading strategy?

- Choosing the right assets to trade.

- Timing each trade to minimize overall risk.

- Getting into each trade “on time”

- Maintaining discipline over position sizes and timelines.

I try to avoid trades where I have to generate a large profit to justify the trade. It’s much easier to achieve success if I have a 20 cent stop and 40 cent target vs a 1.00 stop and a 2.00 profit target. This pattern usually forms because there is a big seller or sellers at a specific price level which will require buyers to buy up all the shares before prices can continuing higher. This type of pattern can result in a explosive breakout because when short sellers notice this resistance level forming they will put a stop order just above it. The flat top breakout pattern is similar to the bull flag pattern except the pullback typically has, as the name implies, a flat top where there is a strong level of resistance.

Nevertheless, the winning portfolios in Griffin et al. study tend to outperform the corresponding indices in America, Europe, and Asia. Chan et al. focuses on international indices but include exchange rate movements as they approach the momentum strategies from the viewpoint of a US investor interested in US Dollars returns. Chan et al. construct portfolios based on indices weighted by their US Dollar returns minus the average US Dollar return of the “world market” of 23 indices from 1980 to 1995.

Is momentum trading suitable for position traders?

By doing so, you create an equally weighted momentum portfolio. Of course, you can tweak the weights to create a skewed portfolio, there is no problem with it, but then you need to have a solid reason for doing so. To help you understand this better, I’ve created a sample tracking universe with just about 10 stocks in it. Hence, evaluating absolute Rupee change will not suffice and therefore we need to look at the percentage change. In terms of percentage change, clearly Stock B’s daily change is higher and therefore we can conclude that Stock B has a higher momentum.

- She has worked in multiple cities covering breaking news, politics, education, and more.

- The indicator appears like a single line that moves up and down below the chart.

- To start trading momentum, you will need to consider the asset that you are interested in.

- This material is not intended for distribution to, or use by, any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation.

This increased predictive power on small stocks is restricted mainly to local posts, which originate from the provinces in which stocks’ headquarters are located. Nonlocal posts exhibit a stronger trend-chasing sentiment than local posts. Furthermore, we find no evidence of the long-term predictive power of message board sentiment. Overall, our findings support the short-term information advantages of local investors. The detection of a momentum trading opportunity is very important so that you can time your entry position in an asset.

Explore the markets with our free course

The momentum indicator is, as you might expect, the most popular momentum indicator. It takes the most recent closing price and compares it to the previous closing price, which can be used to identify the strength of a trend. Momentum trading is the practice of buying and selling assets according to the recent strength of price trends. It is based on the idea that if there is enough force behind a price move, it will continue to move in the same direction.

Trading with the momentum transformer: an interpretable deep … – Risk.net

Trading with the momentum transformer: an interpretable deep ….

Posted: Wed, 22 Feb 2023 08:00:00 GMT [source]

Technical analysis focuses on market action — specifically, volume and price. When considering which stocks to buy or sell, you should use the approach that you’re most comfortable with. There are lucrative profits to be made from momentum investing. For example, say you buy a stock that grows from $50 to $75 based upon an overly positive analyst report. You then sell at a profit of 50% before the stock price corrects itself.

How to use momentum indicators for trading

Discover the range of markets and learn how they work – with IG Academy’s online course. If you do not agree with any term or provision of our Terms and Conditions you should not use our Site, Services, Content or Information. Please be advised that your continued use of the Site, Services, Content, or Information provided shall indicate your consent and agreement to our Terms and Conditions. With the Bull Flag Pattern, my entry is the first candle to make a new high after the breakout. So we can scan for the stocks squeezing up, forming the tall green candles of the Bull Flag, then wait for 2-3 red candles to form a pullback. Sort the chosen stocks and ETFs from highest to lowest to see which are doing the best.

Get stock recommendations, portfolio guidance, and more from The Motley Fool’s premium services. Water Stocks You can’t go wrong with stocks that offer something everything on the planet needs to survive. Momentum trading can make money if things go well, but it isn’t right for everyone.

This is correct to some extent, but that’s not all and we should certainly not limit our understanding to just that. Similarly, one can make more money day trading a highly-volatile stock like Roku than a traditional company like News Corp. In general, there are two primary types of momentum in the market.

Your ability to open a DTTW trading office or join one of our trading offices is subject to the laws and regulations in force in your jurisdiction. Due to current legal and regulatory requirements, United States citizens or residents are currently unable to open a trading office with us. In contrast, a company like Toyota sells more than 8 million cars every year. The reason why Tesla shares have performed so well is that there is momentum going on. From equities, fixed income to derivatives, the CMSA certification bridges the gap from where you are now to where you want to be — a world-class capital markets analyst.

What is an example of momentum trading?

Momentum trading is the practice of trying to make money by trading stocks along with a trend. For example, if a stock is soaring after releasing a stellar earnings report, a momentum trader might try to buy shares and ride the stock's price higher.

So if you were to buy such stocks, then you are to benefit from the expected momentum in the stock. One popular philosophy in momentum trading is that a stock that hits a new high is likely to go even higher. So, one method of finding momentum what is the difference between data and information stocks could be to run a stock screener to filter all of the stocks trading within, say, 5% of their 52-week highs. Whenthe momentum indicatorrises above the zero line, it means the price is trending upward, so it’s a good time to buy.

Step 1 – Define your stock universe

Indicator is one of the most popular indicators, not just for momentum trading but for any technical analysis-based strategy. The MACD uses three exponential moving averages to identify price movements. The difference between these averages is shown in a histogram, whose movement can show whether a trend is strengthening or weakening. Momentum trading is largely based on pure price action and not fundamental elements of why the price is moving in one direction or another.

Enter a buy trade when the trend is up, and the momentum oscillator consolidates below level 100. If the momentum line is swinging around level 100, https://day-trading.info/ the market is not trending, and it is not recommended to trade. Momentum with the period of 4 serves as an oscillator and generates trading signals.

Our Stocks on the Loose and Stocks on a Stroll strategies use our Buoy strategy instead of holding idle cash. Buoy is an expansion of Heine’s Bond Trading Model that uses a combination of trend-following and macro-economic cues to find bonds with the highest returns. The strategy was specifically designed with rising yield rates in mind, as experienced in 2022. The chart above shows how the addition of a bear-market strategy nicely fills in the recession period during which Stocks on the Move stayed flat. Clenow’s strategy only holds idle cash when the market regime filter indicates bearish conditions.

Momentum trading works using the principle of ‘herding’, that traders and investors copy the behaviour of other market participants. It’s the fear of missing out that drives more and more individuals to jump into a trend. The authors compare returns on an equally weighted portfolio during the six months prior to portfolio formation with returns over the subsequent six-month, one-, two-, and three-year periods. Persistence of returns during the later periods provides evidence of momentum.

As a pattern based trader, I look for patterns that support continued momentum. This is where the trader must use their skill to justify each trade. Bull Flags are my absolute favorite charting pattern, in fact I like them so much I made an entire page dedicated to the Bull Flag Pattern. This pattern is something we see almost every single day in the market, and it offers low risk entries in strong stocks. Instead of having to manually flip through charts, I can instantly see stocks that are in play. Stock scanners are what every trader today should be using to find hot stocks, whether it’s penny stocks, small caps, or large caps.

In this case, the indicator will often cross level 100 and move close to the indicator window borders. When the Momentum is close to the window borders, it will signal that the market is in overbought or oversold conditions. You exit a trade when the indicator line breaks through the previous local high or low. The second option to exit a trade is to take the profit when the momentum indicator deviates by a significant value. This is quite a simple Momentum trading strategy that suggests entering a trade when the indicator breaks through level 100. Without looking at the S&P 500 price and using only the momentum indicator, we could assume that the S&P 500 price was rising along with the indicator’s highs above the zero level.

What is a momentum trading strategy?

Key Takeaways. Momentum investing is a trading strategy in which investors buy securities that are rising and sell them when they look to have peaked. The goal is to work with volatility by finding buying opportunities in short-term uptrends and then sell when the securities start to lose momentum.